- TAX LAWYERS, TAX ADVISORY, TAX COMPLIANCE, EXPATS - SYDNEY, BRISBANE, MELBOURNE, CANBERRA

- 1300 334 518

- admin@waterhouselawyers.com.au

Types of Director Penalty Notices (DPNs)

Tax Debt

Types of Director Penalty Notices (DPNs)

A director penalty notice (DPN) is a notice that the ATO can issue to a director of a company that has unpaid debts. There are two types of DPNs – a standard DPN, or a ‘lockdown’ DPN.

A DPN can make the director personally liable for unpaid PAYG withholding tax, a superannuation guarantee charge (SGC) or GST. Personal liability for GST will only apply for amounts due for quarters after 1 April 2020.

The type of DPN that you receive will depend on when the company reported its debts to the ATO and the type of debt.

Depending on the type of DPN you receive, you may be able to avoid personal liability for the company’s tax debt.

Director Penalty Notice (DPN) Types and Liabilities

If the ATO issues a Standard DPN, then you can avoid personal liability if you act within 21 days.

Standard Director Penalty Notice: What it Means

A Standard DPN applies when the relevant reports were lodged with the ATO within a certain period, but the amounts remain outstanding.

Standard DPN for PAYG withholding and GST

A company reports its PAYG withholding tax and GST in its Activity Statements.

If the company lodges these by their due date or within 3 months of their due date, but amounts aren’t paid, then the ATO can issue a Standard DPN to the directors for the unpaid PAYG withholding or GST.

Standard DPN for SGC

For SGC debts, the report is the company’s Superannuation Guarantee Statement. The rules about Standard DPNs for SGC debts changed from 1 July 2018:

- for amounts that fell due before 30 June 2018, a Standard DPN can be issued where the SG Statement was lodged before its due date, or within 3 months of its due date;

- for amounts that fell due on or after 1 July 2018, a Standard DPN can only be issued where the Statement was lodged before its due date.

Avoiding Personal Liability under a Standard DPN

For a Standard DPN, you can avoid personal liability by doing one of three things within 21 days:

• arrange for the company to pay the debts;

• place the company into voluntary administration; or

• place the company into liquidation.

The ATO must remit the director penalty if you do one of these things.

The 21 days start from the date the notice is given to you.

The law says that the notice is given to you when the ATO posts it or leaves it at your address. The 21 days start then – not when you receive it. This means that the risk that the DPN may be lost in the mail is placed on the director, not the ATO.

Lockdown Director Penalty Notice

Under a Lockdown DPN, there is no ability to avoid personal liability by putting the company into liquidation or administration.

Lockdown DPNs apply when the company lodges its statements outside of the specified periods. Those are:

- for SGC that first fell due before 30 June 2018 – the company did not lodge its SGC Statement by the due date or within 3 months of the due date;

- for SGC that first fell due after 1 July 2018 – the company did not lodge its SGC Statement by its due date;

- for PAYG withholding tax and GST – the company did not lodge its Activity Statement by the due date or within 3 months of the due date.

If you are issued a Lockdown DPN, you will have to either arrange for the amount to be paid within 21 days, rely on one of the defences or otherwise challenge the DPN.

Combined DPN

Sometimes the company has lodged some statements within 3 months of their due date, and others have been lodged later. In this case, you may get a ‘combined’ DPN.

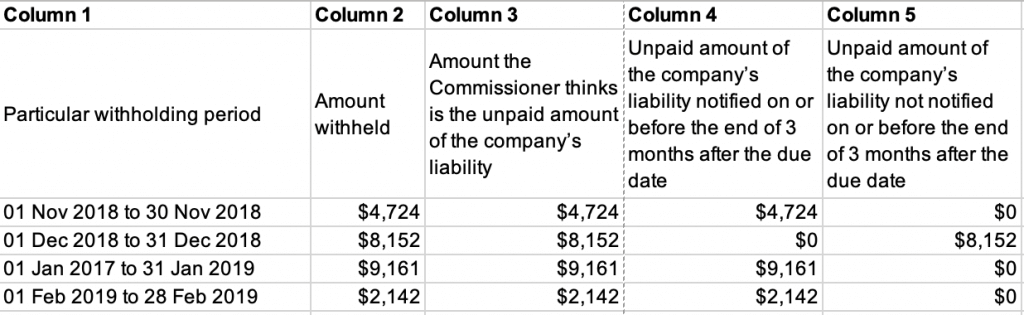

For example, a combined DPN relating to PAYG withholding tax will usually contain a table like this:

The penalty for the amounts in Column 4 would be remitted if you do one of the following within 21 days after the date of the notice:

• arrange for the company to pay the debts;

• place the company into voluntary administration; or

• place the company into liquidation.

On the other hand, the penalty for the amounts in Column 5 will only be remitted if the company pays those amounts within 21 days after the date of the notice.

Credentials

Recognition