- TAX LAWYERS, TAX ADVISORY, TAX COMPLIANCE, EXPATS - SYDNEY, BRISBANE, MELBOURNE, CANBERRA

- 1300 334 518

- admin@waterhouselawyers.com.au

Director Penalty Notice (DPN) – The ATO can collect the same ‘debt’ from many people

Tax Debt

Director Penalty Notice (DPN) – The ATO can collect the same ‘debt’ from many people

The ATO can issue a director penalty notice (DPN) to directors of a company, where that company has unpaid:

- Pay as You Go withholding (i.e. the tax component of staff wages)

- Superannuation Guarantee Charge (i.e. the super component of staff wages)

- Goods and Services Tax (only for GST owed due from the quarter starting 1 April 2020 onwards)

In essence, the DPN makes the directors personally liable where the company hasn’t paid one of the above kinds of tax.

An amount owed under a DPN is a penalty

When the ATO issues a director penalty notice, it makes the director personally liable for a penalty equal to the amount the company hasn’t paid.

That is, it is a separate debt to the amount the company owes, and both debts exist at the same time.

This means that the ATO can either collect the actual tax directly from the company or collect an equal amount from one or more directors as a penalty.

A director penalty is a parallel debt

Even though the ATO can chase either the company and/or the directors for the actual tax (in the company’s case) or the penalty (in the directors’ case), it can’t collect what is essentially the same amount more than once.

This is because a director penalty operates in parallel to the liability owed:

- by the company, and

- by the other directors who have also received DPNs in respect to the same unpaid company tax.

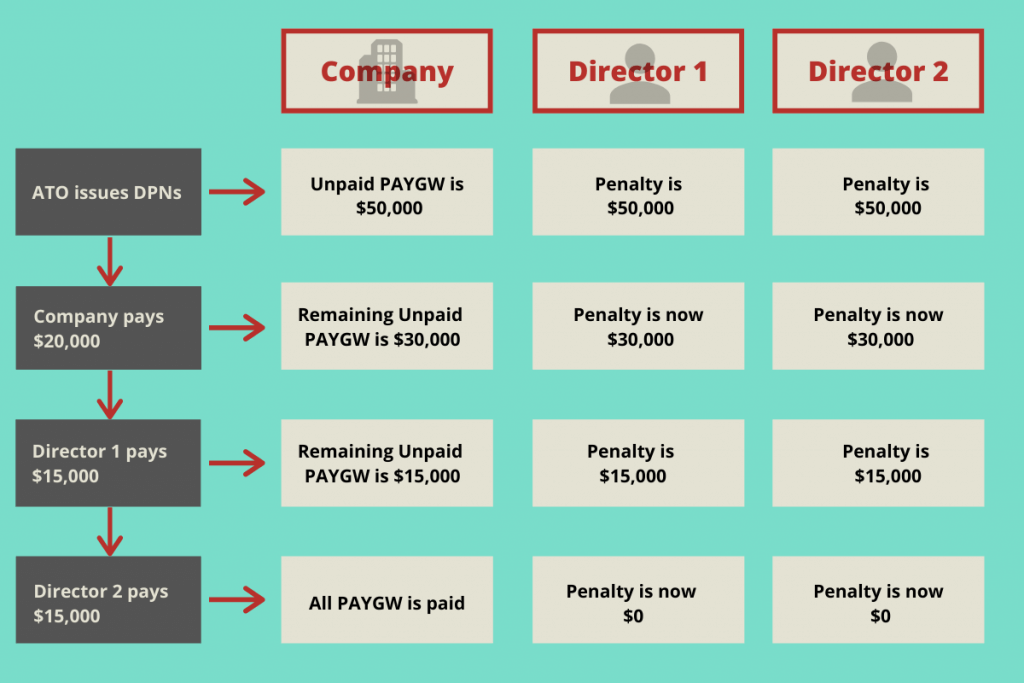

If a director pays some or all of their director penalty, then:

- the company’s liability is reduced by that amount

- the director penalty owed by any other director is reduced by that amount.

Similarly, if the company pays some or all of the relevant tax debt, then the directors’ penalties are reduced accordingly.

This is shown in the following example, where each party has its respective debt reduced when one of the other parties makes a payment.

When a company intends to make a payment towards a particular debt (i.e. in order to reduce the directors’ personal liability), it should give clear directions to the ATO as to how it wants the payment allocated. If it does not do this, the ATO can allocate the payment to another outstanding debt owed by the company. If the payment gets allocated elsewhere, the directors’ penalties will not be reduced.

You can find more information about how the ATO allocates payments in its Practice Statement PSLA 2011/20.

Directors don’t have proportionate responsibility

The ATO can issue DPNs to multiple directors for the same unpaid company debts.

If the ATO issues DPNs to 3 directors, each director is liable for a penalty equal to the full unpaid amount. They are not only liable for 1/3 each.

Even though the ATO can collect from all directors, it can only collect the company’s underlying tax debt once. It can’t collect the full amount from every director.

The ATO does not have to take equal recovery action from every director. This means the ATO can chase one director more aggressively than the others. This would happen where, for example, one director has significant assets and the others do not.

What to do if you receive a DPN

If you receive a DPN, you need to take it seriously and you need to act fast. Some DPNs will allow you to escape personal liability under the DPN if you take certain steps. In other cases, there may be defences available to you or other avenues for challenging the DPN. A tax law expert will be able to help you to investigate all of your options.

Credentials

Recognition