- TAX LAWYERS, TAX ADVISORY, TAX COMPLIANCE, EXPATS - SYDNEY, BRISBANE, MELBOURNE, CANBERRA

- 1300 334 518

- admin@waterhouselawyers.com.au

How the ATO’s general interest charge works

Tax Debt

How the ATO’s general interest charge works

The ATO charges the general interest charge (the GIC) on most unpaid tax debts.

There is legislation that sets out how to calculate the rate of the general interest rate. You can read more about that here.

Daily Compounding: How GIC Accumulates

The rate determined under the law is an annual rate. However, the general interest charge imposed by the ATO is calculated on a daily compounding basis.

The daily rate is worked out by dividing the annual rate for a particular quarter by the number of days in the year. The table below shows how this has worked out in recent quarters.

| Quarter | Annual rate | Daily rate |

| July – September 2020 | 7.10% | 0.01939891% |

| April – June 2020 | 7.89% | 0.02155738% |

| January – March 2020 | 7.91% | 0.02161202% |

| October – December 2019 | 7.98% | 0.02186301% |

| July – September 2019 | 8.54% | 0.02339726% |

Understanding Compound Interest: Impact on Unpaid Tax Debts

The compounding of the interest is important, because it means you are paying interest on interest. It is perhaps best demonstrated with an example.

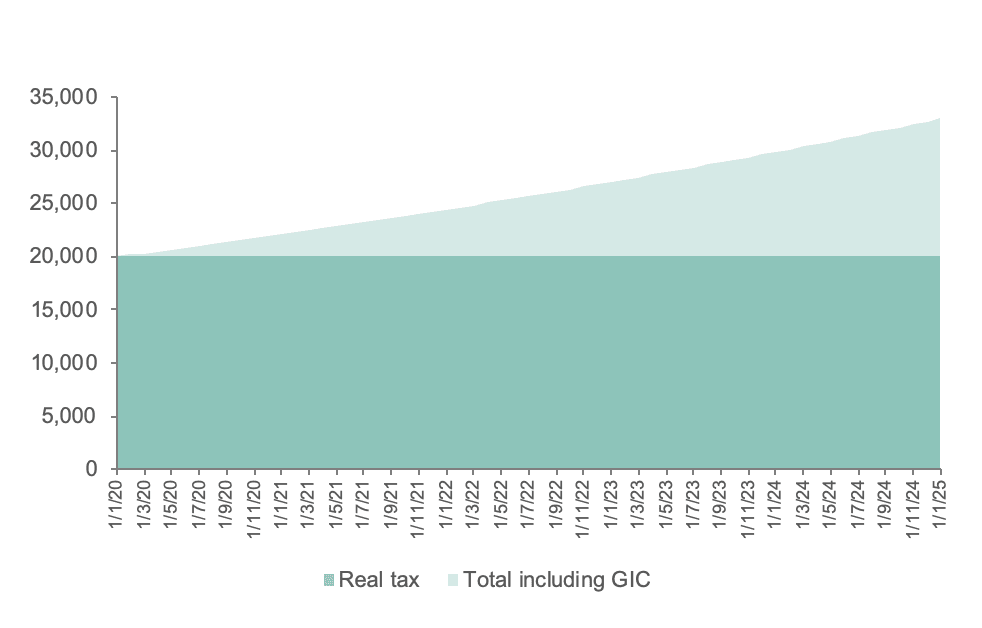

Let’s take a general interest rate of 10%, applied to a debt of $20,000 over 1 year. No payments are made in that year. By year end, the $20,000 debt is now $22,103.12. This means the total interest charge is $2,103.12. Each time more interest is added, it is calculated on the base debt and the accumulated interest.

If the above scenario continues for 5 years, then the $20,000 debt ends up being $32,972.17. Of this, $12,972.17 is the general interest charge.

This table shows how the general interest charge works using the above example figures.

As you can see, an unpaid tax debt can get out of control the longer it is left unaddressed.

There are very few ways to reduce the effect of the daily compounding of the general interest charge.

The obvious way is to pay the debt as quickly as possible. The lower the debt, the lower the interest.

You may be able to reduce your overall costs by obtaining a loan from a bank that charges a lower interest rate, and using that money to pay the ATO.

Or you may be able to have the general interest charge remitted in part or full. You can read more about that here.

RELATED ARTICLES:

Credentials

Recognition